A declaration has been filed by the Form 10BA taxpayer claiming the deduction under section 80GG of the Income Tax Act for rent paid on rental property. This article focuses on how to file Form 10 BA before claiming deduction under Section 80GG.

About Form 10BA

Form 10BA is a statement documented by the taxpayer, which is required to claim deduction under section 80GG for rent paid on rental property. It is mandatory for taxpayers to meet two requirements to claim deduction under section 80GG.

These requirements are as follows:

- The first requirement as per the requirements is that the taxpayer should not obtain a House Rent Allowance (HRA) from any organization.

- The second requirement is that HUF should not keep any self-occupied dwelling. In the case of taxpayer, spouse and minor children, or the assessee be a part of HUF (Hindu Undivided Family).

A taxpayer can submit the statement in Form 10BA if both of the above requirements are met, and it will be mandatory to file the form before filing the Income Tax Return.

Section 80GG of the Income Tax Act,1961 talks about the reduction in rent paid on rental property, whether it is furnished or unfounded. The taxpayer should not receive any HRA (House Rent Allowance) from his organization. The above mentioned condition is necessary for the taxpayer to claim deduction under Section.

Conditions For Deduction Under Section 80GG

Following are the conditions for claiming deduction under section 80GG:

- A self-governing person can claim deduction only under section.

- The person claiming the deduction can be a salaried or self employed person.

- In case of a salaried person, one should not get HRA (House Rent Allowance) from his organization.

- From 10BA has to be submitted to the Income Tax Department.

- The assessee should not in any case have self-occupied property like a house.

- Assessment of spouse, minor children or taxpayer, a member of the HUF should not have a comfortable living space where he or she is living under employment or offering occupation or service.

Let’s Understand by examples:

The following are understood through an example of this concept.

One person worked for the initial six months, and after that, he started working as a freelancer. He lived on rented property for the entire year and took HRA, and has no self-owned property. He can claim deduction under Section 80GG and in the present case files Form 10BA for the rent of the last 6 months paid by him.

Purpose of Deduction Under Section 80GG & Filing Form 10BA

For FY 2018-19 and AY 2019-20, the deduction under the section should be at least:

- Payment of full rent which is less than 10% of the entire income.

- 25% annual payroll deduction

- Rupee. 5000 monthly (this means it is Rs. 60,000 annually)

Here is a list of requirements for claiming deduction:

- The assessee should not in any case have self-occupied property like a house.

- A self-governing person can claim deduction only under section.

- In case of a salaried person, the person should not obtain HRA (House Rent Allowance) from his organization.

- The person claiming the deduction can be a salaried or self employed person.

- Assessment of spouse, minor children, or taxpayer, a member of the HUF should not have a comfortable living space where he or she is living under employment or offering occupation or service.

- Form 10BA must be submitted to the Income Tax Department.

List of ITR Forms Applicable Under Section 80GG

The list of ITR forms implemented under Section 80GG are as follows:

- ITR 1

- ITR 2

- ITR 3

- ITR 4

The expected date for filing ITR has been set as July 31 of the next financial year.

Documents required for filing Form 10BA

Further, to documents including Form 16 and PAN details, file forms are the documents required for filing:

- Rent Agreement and Rent Voucher

- PAN details of the landlord, if the value of rent is more than Rs. 1 lakh.

Form 10BA is therefore filed which ensures that the landlord is not declaring the benefit of the self-occupied house at the same or any other place.

Procedure for filing Form 10BA

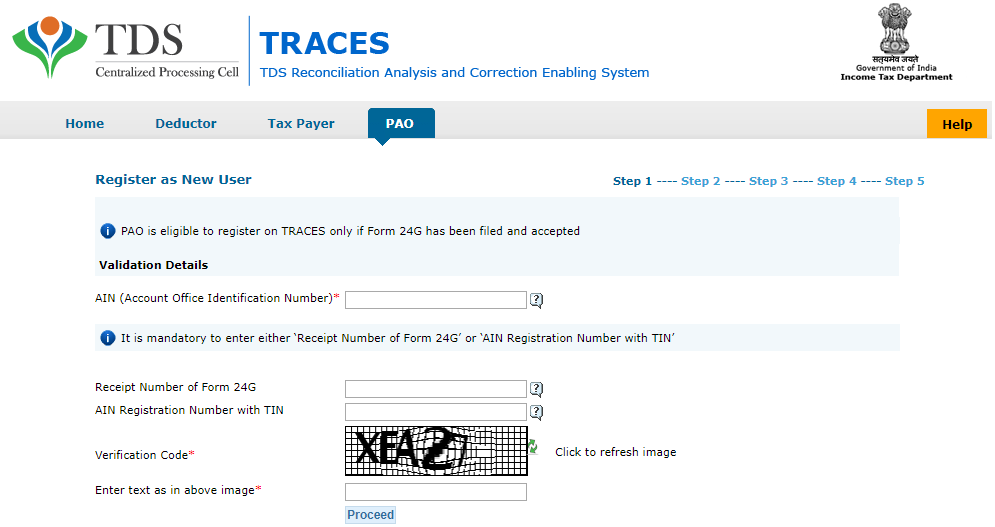

10BA is required to be filed online through an e-filing portal, which is very easy. Following are the online steps to fill the form:

- Go to the Income Tax e-filing portal and login through credentials.

- Go to the e-file option and choose the income tax form.

- Choose Form 10BA from the drop-down menu, and then choose the corresponding assessment year.

- Select the submission mode and submit it online.

- Then click on Continue.

- Enter all the details including the name of the landlord, how much rent has been paid, rent property address etc.

- Preview the form and then submit it.

Details required in Form 10BA

The following details are required in Form 10BA:

- Taxpayer name

- PAN Details

- Rental Property Address

- Paid the rent

- Landlord’s name and address

Conclusion

Form 10BA is a statement that should be filed on the Income Tax website under the e-filing portal. The form is filed to claim deduction under Section 80GG of the Income Tax Act. Thus, it is preferable to file Form 10BA before filing ITR and claim deduction from rent under Section 80GG.