The Income Tax Department has introduced the concept of TDS TRACES, in which taxpayers and deductors have explained the entire process as well as can easily download the challan details from here. Apart from this, the mistakes made in the previously filed returns can also be rectified.

Know About TDS TRACES

TRACES, TDS Reconciliation Analysis and Correction Enabling System is in fully expanded form. The Income Tax Department has introduced this online facility to make the process efficient and to rectify the already filed TDS returns. This avoids the task of filing revised returns for the process of rectification, which is a time-consuming process. Taxpayers and deductors can easily access the TRACES website through an online process. One can refer to TDS and TCS paid while filing the return to ask for further details and to check the details.

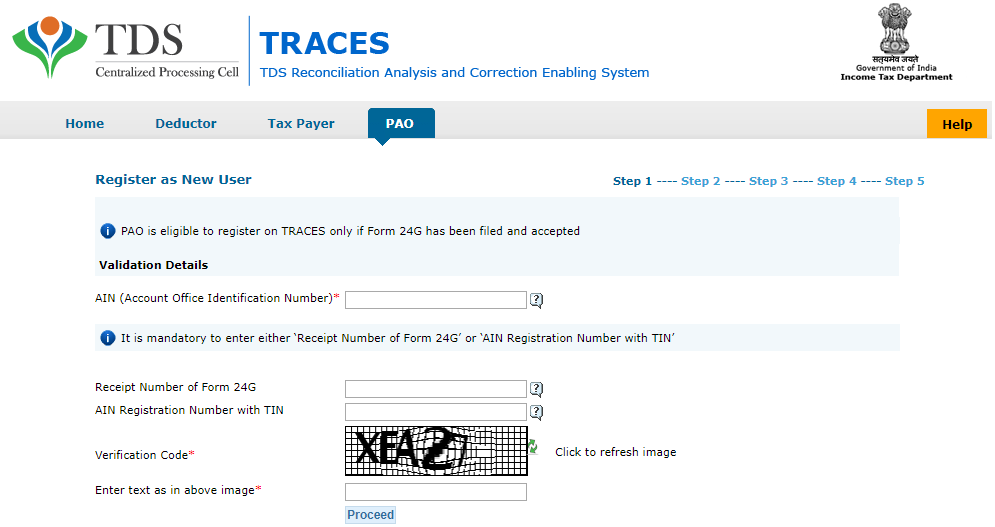

TDS TRACES Registration

Registration on TDS TRACES can be done as both taxpayers and deductors.

As a Taxpayer

- Go to the website (www.tdscpc.gov.in).

- Select the taxpayer option and then click Register as a new user.

- It is necessary to provide the following details to the applicant:

- Name

- In case of date of birth or company date of incorporation

- PAN Details

- Verification Code

- After filling in these details, click on proceed.

- In addition, the following details are required:

- TDS or TCS details through Form 26AS or Form 16 / 16A

- Details through Form 26QB

- Statement of advance tax, self-assessment tax, TDS on the property paid from the challan.

- Go ahead and then provide the applicant’s communication details.

- Then create an account and verify the details entered, and click proceed.

- The taxpayer will receive an activation link. The message will be sent to the registered email and mobile number by the taxpayer. In this message, click on the link and activate the account from OTP.

- After this, TDS TRACES login.

As a Deductor

- Visit website (www.tdscpc.gov.in)

- Select the deductor option and then click Register as a new user.

- Fill in the required details:

- TAN

- Verification Code.

The system will automatically detect details such as form type, fiscal year and quarterly.

- The deductor will be required to enter a TDS Return Token Number or PRN (Provisional Receipt Number).

- A valid CIN, BSR code, date of deposit, invoice amount and CD record number are provided along with the challan number.

- A maximum of 3 PAN-amount combinations are filed by the deductor and a TDS file has to be submitted against the PAN as well.

- The deductor will then have a validation code valid for the previous financial year, quarter and type of form. Enter the authentication code to proceed.

- Go ahead and then provide the applicant’s communication details.

- Then create an account and verify the details entered, and click proceed.

- An activation link will be received on the deductor’s registered email and mobile number. Click on the link that came in the email and mobile messages. Activate the account by receiving OTP.

- Then login TDS TRACES and take advantage of the services offered in it.

Use of TDS TRACES

The TDS TRACES website allows taxpayers as well as TDS Deductor to perform various activities, but has some limitations:

- TCS / TDS file for rectification

- View challan status

- Submit refund request online

- View and download Form 26AS

- Complete online correction of previously filed TDS returns

- Check the status of various tax details online

- Download the consolidated file, justification report and both Form 16 and 16A.

- Online correction of OLTAS challan.

TDS TRACES has transformed the complex and paper-based system that allows taxpayers and deductors to take advantage online.

Facilities available at TDS TRACES

The following are the main facilities offered by TDS TRACES to the taxpayer:

- Download Form 26AS and Form 16B

- TDS Certificate Verification

- The collected TDS compliance report can be studied and downloaded from here.

The facilities offered by TDS TRACES to deductors are:

- The status of the challan can be seen

- Download Form 16 and Justification Report

- Online improvement

- TDS Refund

- View TDS / TCS Credit against PAN

- Declaration of non-filing statement.

TDS Challan Checking Process on TRACES

It is of utmost importance to check the TDS details while filing your quarterly TDS or TCS return. Checking can easily be done by logging into the TRACES account. The status of the challan can be seen by CIN (Challan Identification Number) or BIN (Book Identification Number). By providing a CIN or BIN, the status of the invoice can be seen by the duration of the payment.

Following are the steps to check TDS Challan on Trucks, which are:

Step 1: Log in to the TRACES portal using credentials.

Step 2: Then move the cursor over the statement or payment link in the top menu. Click the status of the invoice from the drop-down menu on it.

Step 3: Check the status of the challan by CIN or BIN.

CIN

In case of CIN, select the CIN option to check the status of the challan. After that choose the payment term and click proceed. A list will appear for the status of the movement, where the details will be found.

BIN

In the case of BIN, select the BIN option to check the status of the challan. Choose the payment term, then click Go. After clicking enter BIN details on the open page, then view consumption details and click on it.

Conclusion

The Income Tax Department has introduced the concept of TDS TRACES, in which taxpayers and deductor can study the challan, as well as download the challan details. TRACES taxpayers can rectify mistakes made in previously filed returns with this new concept and also provide a number of features for deductions on its taxpayers.