Introduction to Peer-to-Peer Lending

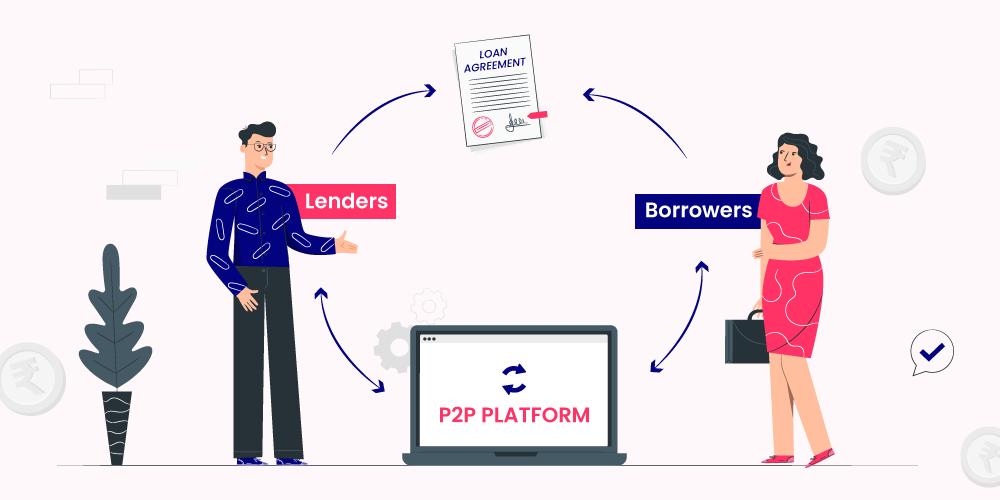

As the world becomes increasingly interconnected, new financial opportunities are emerging. One such opportunity is peer-to-peer lending, a form of lending that connects borrowers directly with lenders through online platforms. This innovative model allows individuals and businesses to access funding without the need for traditional financial intermediaries.

Understanding the Importance of License Registration for Peer-to-Peer Lending Platforms

While peer-to-peer lending offers many benefits, platforms must operate within a legal framework to ensure the safety and security of lenders and borrowers. License registration is essential in establishing a legitimate and trustworthy peer-to-peer lending platform. It provides credibility to the platform, instills confidence in lenders and borrowers, and ensures compliance with relevant laws and regulations.

The Legal Framework for Peer-to-Peer Lending License Registration in India

In India, the Reserve Bank of India (RBI) is the regulatory authority responsible for overseeing and regulating peer-to-peer lending platforms. The RBI has implemented a comprehensive legal framework to govern these platforms and protect the interests of lenders and borrowers. The peer-to-peer lending license registration process in India involves fulfilling certain criteria and complying with specific regulations.

To start the license registration process, the platform must be registered as a company under the Companies Act, 2013. The platform must also have a net-owned fund of at least INR 2 crore and meet other financial requirements. Additionally, the platform must adhere to guidelines regarding exposure limits, interest rate caps, and fund transfer mechanisms.

Step-by-Step Guide to Online Registration for Peer-to-Peer Lending License in India

- Company Registration: Register the platform as a company under the Companies Act, 2013. Obtain the necessary documents, such as the Memorandum of Association and Articles of Association.

- Net Owned Fund: Ensure the platform has a net-owned fund of at least INR 2 crore. This can be achieved through capital infusion or accumulation of profits.

- Technology Infrastructure: Develop a robust technology infrastructure to support the platform’s operations, including a secure website, data protection measures, and customer support systems.

- Board of Directors: Appoint a competent and experienced board of directors who will oversee the operations of the platform and ensure compliance with regulations.

- Application Submission: Prepare and submit the license application to the RBI, including all necessary documents and information required.

- Background Verification: The RBI will conduct a background verification of the platform’s promoters and directors to ensure their suitability for operating a peer-to-peer lending platform.

- Approval and Compliance: Upon successful verification, the RBI will grant the peer-to-peer lending license. The platform must then comply with all regulatory requirements and guidelines stipulated by the RBI.

Documents Required for Peer-to-Peer Lending License Registration

To complete the license registration process, certain documents must be submitted to the RBI. These documents include:

- Memorandum of Association and Articles of Association: The goals, policies, and procedures of the business are described in these documents.

- Business Plan: A comprehensive business plan that outlines the platform’s operations, marketing strategy, risk management framework, and financial projections.

- Audited Financial Statements: Provide audited financial statements for the last three years, including balance sheets, profit and loss statements, and cash flow statements.

- KYC Documents: Submit Know Your Customer (KYC) documents of the platform’s promoters and directors, such as identity proofs, address proofs, and photographs.

- Technology Infrastructure Details: Provide details of the platform’s technology infrastructure, including servers, security measures, data protection protocols, and disaster recovery plans.

- Risk Management Framework: Present a detailed risk management framework that encompasses credit assessment, borrower verification, and default recovery mechanisms.

The Process of Obtaining a Peer-to-Peer Lending License in India

The process of obtaining a peer-to-peer lending license in India involves several steps. Once the license registration application is submitted, the RBI will conduct a thorough review of the application and supporting documents. The RBI may seek additional information or clarification during this review process.

Upon successful verification, the RBI will grant the peer-to-peer lending license. The platform will then be required to comply with ongoing regulatory requirements, such as reporting financial statements, maintaining capital adequacy, and conducting periodic audits.

Compliance and Regulatory Requirements for Peer-to-Peer Lending Platforms

After obtaining the peer-to-peer lending license, platforms must adhere to various compliance and regulatory requirements. These requirements include:

- Exposure Limits: Platforms must comply with exposure limits that determine the maximum amount a lender can lend to a single borrower.

- Interest Rate Caps: The RBI has implemented interest rate caps to protect borrowers from excessive interest rates. Platforms must ensure that the interest rates charged to borrowers are within the prescribed limits.

- Fund Transfer Mechanisms: Platforms must establish secure and efficient fund transfer mechanisms for seamless transactions between lenders and borrowers.

- Data Protection and Security: Platforms must implement robust data protection measures and ensure the security of personal and financial information shared by lenders and borrowers.

Benefits of Obtaining a Peer-to-Peer Lending License

Obtaining a peer-to-peer lending license offers several benefits for both platform operators and users. For platform operators, it provides credibility and legitimacy, attracting more lenders and borrowers to the platform. It also enables platforms to access institutional funding and expand their operations.

For lenders, a licensed platform ensures transparency, fair practices, and regulatory oversight. Borrowers benefit from competitive interest rates, streamlined loan application processes, and access to a diverse pool of lenders.

Common Challenges and Solutions During the License Registration Process

During the license registration process, platforms may encounter various challenges. These challenges can include complex regulatory requirements, lengthy approval timelines, and the need for robust technology infrastructure. However, with careful planning and expert guidance, these challenges can be overcome.

Platforms should engage legal and compliance professionals specializing in peer-to-peer lending regulations to ensure a smooth license registration process. They should also invest in developing a secure and scalable technology infrastructure to meet regulatory requirements and provide a seamless user experience.

Conclusion: Unlocking the Potential of Peer-to-Peer Lending through Proper License Registration

Peer-to-peer lending has the potential to revolutionize the financial industry, offering a new way for individuals and businesses to access funding. However, to unlock this potential, peer-to-peer lending platforms must obtain the necessary license registration and comply with regulatory requirements.

By following a step-by-step guide and fulfilling the required criteria, platforms can establish a legitimate and trustworthy presence in the market. Licensing provides credibility, instills confidence in lenders and borrowers, and ensures compliance with relevant laws and regulations.

With a licensed platform, lenders and borrowers can tap into the benefits of peer-to-peer lending, including competitive interest rates, streamlined processes, and access to a wide range of funding options. Proper license registration is the key to unlocking the full potential of peer-to-peer lending and creating a sustainable and thriving ecosystem.